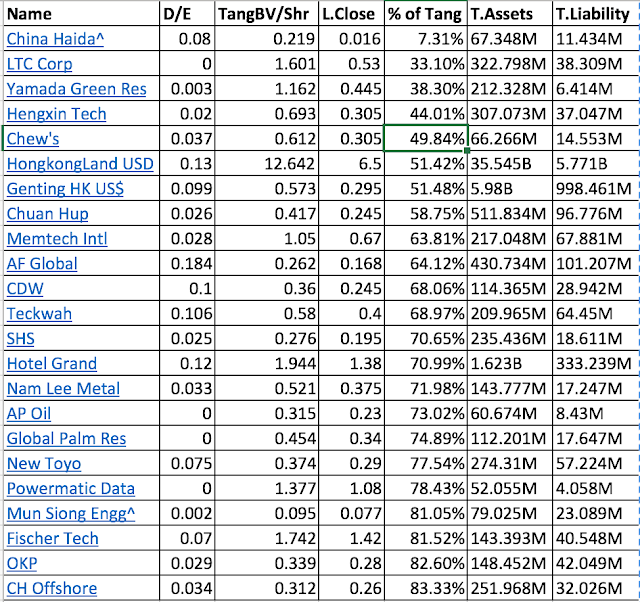

This post is made in reference to an earlier blog post. Basically, it is a list of stocks that has last closed prices at a significant discount to its tangible book value.

The first item on the list is China Haida, which is an S-Chip. Reputation wise, s-chips get a really bad name. But I believe in keeping an open and critical mind when investigating value stocks. Can this s-chip, penny stock be worth the risk?

Apparently SGX has been monitoring and the key concern is Interested Party Transactions. One of the easiest way to move capital out from a company is to write off account receivables, and hence buying a stock like China Haida is a risky venture.

I shall pass.

Pages

Search This Blog

Saturday, December 31, 2016

Sunday, December 11, 2016

Investigating Cheap Stock by Book Value

This list of stocks is unlikely to appeal to many people. Some of these are s-chips, and all if not most of them are experiencing problems, usually no profits at all. As you can see, most of them have next to no debt, and are selling at lower than its tangible assets per share.

More importantly, some of them are value traps, which refers to stocks that look cheap but isn't because of a variety of reasons-- management could be one of them.

I find this list of stocks intriguing and will be working to go through all of them. Diversification is the key, and over a long period of time, it will work to my favor.

More importantly, some of them are value traps, which refers to stocks that look cheap but isn't because of a variety of reasons-- management could be one of them.

I find this list of stocks intriguing and will be working to go through all of them. Diversification is the key, and over a long period of time, it will work to my favor.

Thursday, December 1, 2016

A Small Sum of Money

With a small sum of savings generating next to nothing interest in banks, my mum and I decided to close the account and invest this in some stocks. Since this money isn't really mine, I take on a much more prudent approach.

I diversified the capital in 4 stock at the moment and is disappointed not to be able to get to the 5th today, but I will wait

1) Hong Kong Lands- This company is the only one in the list that has a moat and is probably also the riskiest due to currency risk. However capital protection is assured and looking at charts, we are not at the high side/resistance. With its record of growing its NAV and also its properties, which are not easily replaceable in good times, it is pretty safe.

Dividend Yield is not fantastic at 3% but I imagine with its pretty low debt and brand name (most of its debt are unsecured, that is how much banks trust them).... I think it is safe.

2) Capitaland Retail China Trust

I believe in the management in overcoming its current problems. At 1.37, the book value of it being 1.55 and gearing at 36%, I think it is not the safest security but it is fine.

3) Chuan Hup

Low debt and good record increasing its book value. At the moment its subsidiary Finbar isn't doing too well but I believe sooner or later, in 4 years, things will change. Dividends at 4% will pay off.

4) Frasers Centrepoint Trust

Selling at book value and low gearing (28.3%). Good yield at 6%. I believe that malls serves as valuable meeting point for heartlanders as the city gets crowded.

I was looking at adding Nam Lee Metal but the stock rose too quickly today. I estimate that this company has a safe book value of 0.42 and we are looking at a 6 percent increase today. Nam Lee Metal is another company with little debt.

I am also monitoring the price of Mapletree Industrial Trust and will add if there is significant discounting.

I diversified the capital in 4 stock at the moment and is disappointed not to be able to get to the 5th today, but I will wait

1) Hong Kong Lands- This company is the only one in the list that has a moat and is probably also the riskiest due to currency risk. However capital protection is assured and looking at charts, we are not at the high side/resistance. With its record of growing its NAV and also its properties, which are not easily replaceable in good times, it is pretty safe.

Dividend Yield is not fantastic at 3% but I imagine with its pretty low debt and brand name (most of its debt are unsecured, that is how much banks trust them).... I think it is safe.

2) Capitaland Retail China Trust

I believe in the management in overcoming its current problems. At 1.37, the book value of it being 1.55 and gearing at 36%, I think it is not the safest security but it is fine.

3) Chuan Hup

Low debt and good record increasing its book value. At the moment its subsidiary Finbar isn't doing too well but I believe sooner or later, in 4 years, things will change. Dividends at 4% will pay off.

4) Frasers Centrepoint Trust

Selling at book value and low gearing (28.3%). Good yield at 6%. I believe that malls serves as valuable meeting point for heartlanders as the city gets crowded.

I was looking at adding Nam Lee Metal but the stock rose too quickly today. I estimate that this company has a safe book value of 0.42 and we are looking at a 6 percent increase today. Nam Lee Metal is another company with little debt.

I am also monitoring the price of Mapletree Industrial Trust and will add if there is significant discounting.

Wednesday, November 16, 2016

A Short Look at ISOTeam

ISOteam is a stock that has done very well. From about 15cents in 2013, it has since went up to 38.5 cents today. Fundamentally, any company can be solid, but just as likely expensive. The charts indicate that 'investors' are adopting a wait and see attitude most of the time.

ISOteam is a stock that has done very well. From about 15cents in 2013, it has since went up to 38.5 cents today. Fundamentally, any company can be solid, but just as likely expensive. The charts indicate that 'investors' are adopting a wait and see attitude most of the time.Interestingly enough, the management decided to buy back some shares today. For the uninitiated, buying back shares mathematically increase Earnings Per Share (EPS), since there are less shares to go around. However, the amount bought back, 55000 shares, represent a small drop in its ocean of 280++ million shares!

Share buybacks could be used for stock options. I do not think that the stock prices are cheap and there is a pessimistic air about its stock (yet!), hence I question the timing of buying it now.

Reading the annual report, the Myanmar growth story so far yields only a $110,000 project, which is also a drop in the ocean of its 9million or so revenue the entire last year. The annual report mentioned that it has yet to get any new projects locally. This is another warning sign.

Let's take a look at my calculations of its ROIC for the last 4 years. I believe in ROIC-- it prevents me from being blind by exciting revenue growth.

2012- 18.11%

2013- 32.05% <-- mighty good year, but probably abnormal. Should discount for statistical use.

2014- 20.98%

2015- 16.77%

I think ISOTeam definitely needs new projects locally and more importantly overseas, since I believe it isn't cheap on cashflow. Another thing that worries me is the unbalance of power in its Board, since all 3 of the co-founders are in it, and for some reason, they are always around during board meetings that does not require their presence ("by invitation," haha).

The last thing that one should take note of is its acquisitions-- it seems to have overpaid in goodwill for one of them-- but that is my opinion...

In short:

- fair average board with no political links to harness.

- not too convinced of its growth story overseas, and it is possibly running into heavy competition locally.

- dropping ROIC.

- possibly overpaying in acquisitions (acquiring companies is bad enough).

Saturday, November 12, 2016

Volatility and Dangerous Opportunities

While the votes were counted for the US Presidential Elections, the singapore stock market experienced frightening declines. Banks stocks were sold down heavily, and gold and companies dealing with the precious commodity got bid up a little too quickly.

The obvious opportunity is to buy gold or these companies as a hedge against a downturn. I refuse to subscript to this theory because of some well-known arguments, such as:

1) You can't analyze the value of gold. It is entirely speculative.

2) Even if the value of gold is ascertainable, you are not paid to wait (no dividends) while the market corrects itself.

3) Prices of gold mining company stocks move along with these gold prices and even if they are deem cheap by book value or discounted cash flow, it is not worth it due to (2), as these companies usually will not pay a dividend.

That said, it came as a shock to me that equities "recovered" (I loathe to use this term because only stock prices moved, companies function normally during this event), the prices of gold plunged very quickly and so was the prices for these gold-related companies. I do have a friend right now which is stuck with a gold mining stock. Personally, I think the fair value of this company is 0.510, and that is the case right now. However, I subscript to view (3) and (2) and think that Singtel is a better bet.

***

I am blessed to be consuming bit and pieces of wisdom from John Templeton's book, Investing the Templeton Way. Hopefully I will finish the book and write a review of it.

The obvious opportunity is to buy gold or these companies as a hedge against a downturn. I refuse to subscript to this theory because of some well-known arguments, such as:

1) You can't analyze the value of gold. It is entirely speculative.

2) Even if the value of gold is ascertainable, you are not paid to wait (no dividends) while the market corrects itself.

3) Prices of gold mining company stocks move along with these gold prices and even if they are deem cheap by book value or discounted cash flow, it is not worth it due to (2), as these companies usually will not pay a dividend.

That said, it came as a shock to me that equities "recovered" (I loathe to use this term because only stock prices moved, companies function normally during this event), the prices of gold plunged very quickly and so was the prices for these gold-related companies. I do have a friend right now which is stuck with a gold mining stock. Personally, I think the fair value of this company is 0.510, and that is the case right now. However, I subscript to view (3) and (2) and think that Singtel is a better bet.

***

I am blessed to be consuming bit and pieces of wisdom from John Templeton's book, Investing the Templeton Way. Hopefully I will finish the book and write a review of it.

Thursday, October 27, 2016

Does M1 Deserves it Current Predicament?

Many months ago, I calculated the book value per share and debt-to-equity, as well as ROE of the three telcos, and surmised that the balance sheet of Singtel is the strongest of them all. It was also the cheapest company based on book value per share.

I shared this little piece of information to a forum and was pointed out, by a rather senior member of the forum, that Starhub was trading at a huge price over its book value because most of its assets had been written down to zero. Part of them could be the cable business.

As such, I shelved my interest in all telcos, but recognize the attractive dividends that Starhub and M1 paid to their shareholders. However, Singapore is a small market for a mature industry.

Recently M1 announced a dramatically decrease in revenues compared to its quarter last year. I think perhaps a comparison over the Return of Invested Capital (ROIC) over a period of 10 years would be a fairer means of checking which is a better telco, since their balance sheet composition are, possibly, vastly different.

My method of calculating ROIC would be

taking Net Operating Profit after Tax (NOPAT), without taking into account interest charges,

and taking this sum,

divide by Invested Capital, which is all Debts + Equity

M1's annual reports are available at

https://www.m1.com.sg/aboutm1/investors/annualreports

and the figures used would be from 2006 to 2015, in thousands unless specified.

2006

NOPAT = 174839

Invested Capital (IC) = 631968

ROIC = 27.67%

2007

NOPAT = 171801+ 9472 = 181273

Invested Capital = 201,911 + 250,000 + 35,000 = 486911

ROIC = 37.23%

2008

NOPAT = 157687

IC = 473232

ROIC = 33.32%

2009

NOPAT = 156764

IC = 525113

ROIC = 29.85%

2010

NOPAT = 162901

IC = 618894

ROIC = 26.32%

2011

NOPAT = 170021

IC = 625847

ROIC = 27.17%

2012

NOPAT = 151991

IC = 619914

ROIC = 24.51%

2013

NOPAT = 164665

IC = 645096

ROIC = 25.53%

2014

NOPAT = 179821

IC = 696570

ROIC = 25.82%

2015

NOPAT = 183400

IC = 767013

ROIC = 23.91%

2016 (3 quarters announced so far.)

NOPAT = 117.9M + 4.7M = 122.6M

IC = 772.4M

In order for M1 to maintain last year ROIC,

Assuming it maintains its debts and equity,

it must post 62.08M of profits in the last quarter this year...

One would take note that it was performing well in 2006-7, and dip dramatically from 2008-10, didn't perform too badly between 2010-4, but started sliding down for the last two years.

In summary, this year's ROIC could well be the worst performing year for M1 in a decade. Perhaps, in the next post, I will look at Starhub's.

I shared this little piece of information to a forum and was pointed out, by a rather senior member of the forum, that Starhub was trading at a huge price over its book value because most of its assets had been written down to zero. Part of them could be the cable business.

As such, I shelved my interest in all telcos, but recognize the attractive dividends that Starhub and M1 paid to their shareholders. However, Singapore is a small market for a mature industry.

Recently M1 announced a dramatically decrease in revenues compared to its quarter last year. I think perhaps a comparison over the Return of Invested Capital (ROIC) over a period of 10 years would be a fairer means of checking which is a better telco, since their balance sheet composition are, possibly, vastly different.

My method of calculating ROIC would be

taking Net Operating Profit after Tax (NOPAT), without taking into account interest charges,

and taking this sum,

divide by Invested Capital, which is all Debts + Equity

M1's annual reports are available at

https://www.m1.com.sg/aboutm1/investors/annualreports

and the figures used would be from 2006 to 2015, in thousands unless specified.

2006

NOPAT = 174839

Invested Capital (IC) = 631968

ROIC = 27.67%

2007

NOPAT = 171801+ 9472 = 181273

Invested Capital = 201,911 + 250,000 + 35,000 = 486911

ROIC = 37.23%

2008

NOPAT = 157687

IC = 473232

ROIC = 33.32%

2009

NOPAT = 156764

IC = 525113

ROIC = 29.85%

2010

NOPAT = 162901

IC = 618894

ROIC = 26.32%

2011

NOPAT = 170021

IC = 625847

ROIC = 27.17%

2012

NOPAT = 151991

IC = 619914

ROIC = 24.51%

2013

NOPAT = 164665

IC = 645096

ROIC = 25.53%

2014

NOPAT = 179821

IC = 696570

ROIC = 25.82%

2015

NOPAT = 183400

IC = 767013

ROIC = 23.91%

2016 (3 quarters announced so far.)

NOPAT = 117.9M + 4.7M = 122.6M

IC = 772.4M

In order for M1 to maintain last year ROIC,

Assuming it maintains its debts and equity,

it must post 62.08M of profits in the last quarter this year...

One would take note that it was performing well in 2006-7, and dip dramatically from 2008-10, didn't perform too badly between 2010-4, but started sliding down for the last two years.

In summary, this year's ROIC could well be the worst performing year for M1 in a decade. Perhaps, in the next post, I will look at Starhub's.

Sunday, October 23, 2016

Recommended Book List (as of 23-Oct-2016)

A year had passed since I bought my very first stock.

I attributed whatever profits and desire to learn from my losses in the stock market. Since then, I read a few books and think that they wouldn't hurt any investors.

Must reads:

The Five Rules for Successful Stock Investing

The Intelligent Investor

Good to have:

F Wall Street

Introduces bond laddering, DCF with existing equity in mind, cash yield%, etc.

One Up on Wall Street

The Little Book on Big Safe Dividends

Common Stocks and Uncommon Profits

Michael Burry's posts on MSN Money (Brilliant value investor, do not let his reputation in "The Big Short" cloud your impression of him)

Wish I can understand, but couldn't:

Aswath Damodaran's books (Investment Valuation, Little Book of Valuation)

Security Analysis

There you go, perhaps one day I will add more.

I attributed whatever profits and desire to learn from my losses in the stock market. Since then, I read a few books and think that they wouldn't hurt any investors.

Must reads:

The Five Rules for Successful Stock Investing

The Intelligent Investor

Good to have:

F Wall Street

Introduces bond laddering, DCF with existing equity in mind, cash yield%, etc.

One Up on Wall Street

The Little Book on Big Safe Dividends

Common Stocks and Uncommon Profits

Michael Burry's posts on MSN Money (Brilliant value investor, do not let his reputation in "The Big Short" cloud your impression of him)

Wish I can understand, but couldn't:

Aswath Damodaran's books (Investment Valuation, Little Book of Valuation)

Security Analysis

There you go, perhaps one day I will add more.

Friday, October 14, 2016

An Arbitrage Trap of Sorts

Investors trying to profit from Twitter's possible buy-out deal are burnt badly twice just this month. With Disney, Verizon, Google (somehow I think they are best suited to buy Twitter) walking away, the news of Salesforce deciding not to "rescue" Twitter left Softbank as the only _rumoured_ entity to be interested.

I personally think there are a few reasons why this is a not an opportunity for an arbitrage

1) Twitter management did not show any interest to be acquired

2) There were no official talks announced, as such anything is speculative.

3) They are not in a dire situation yet; They have about 3B in cash and about 1.5B in debt, with a total of 2B in liabilities. The problem is profits are not coming, equity dilution, tons of stock-based compensation for employees.

As such, this isn't a distressed opportunity and neither is Twitter undervalued.

|

| Never ever get involve in an IPO; it was sold at 69/share at its height |

1) Twitter management did not show any interest to be acquired

2) There were no official talks announced, as such anything is speculative.

3) They are not in a dire situation yet; They have about 3B in cash and about 1.5B in debt, with a total of 2B in liabilities. The problem is profits are not coming, equity dilution, tons of stock-based compensation for employees.

As such, this isn't a distressed opportunity and neither is Twitter undervalued.

Tuesday, September 27, 2016

What I think about Insider Trading

Just today, I was alerted by the very useful SGX Mobile iPhone app that Sing Holdings (5IC) is likely to secure a land parcel for development from Urban Redevelopment Authority.

This wouldn't raise an eyebrow except that Sing Holdings recorded an extraordinary, unexplained increase of about 10 percent within a single day, with large volume.

There were no news released that day (at least officially), and this is probably attributed to some kind of insider trading.

I have already sold my shares in this company because I think I need to revise my idea of an asset play. Whether the market decided to act otherwise is not in my control nor my interest... I need to hold forth to my ideas stubbornly.

But I do have some views on insider trading.

Firstly, they are, definitely something we can do without, for it propagates the idea that in order to make a decent amount of money from the stock market, you need to have insider information. You can never eradicate insider trading with regulation...

Secondly, it takes some courage to act upon insider info. Let me explain.. for instance, an associate will advise me that company ABC is going to announce that they have secure a large project, and it is best to act upon it.

My first question will be: How big is this project? The second question will be: When will it happen?

It is also foolhardy to assume that the catalyst will happen within days. For instance, how would you felt if the price plunged by 1%, with a slightly larger than normal volume? Would you steadfastly held on? After all, technical analysis is about reading crowd emotion and by buying on insider information, you are influenced by a mere 1 person, how about more?

If a certain Mr Schloss could hide inside a small office, meet no management, and yet make plenty of money, why not?

This wouldn't raise an eyebrow except that Sing Holdings recorded an extraordinary, unexplained increase of about 10 percent within a single day, with large volume.

There were no news released that day (at least officially), and this is probably attributed to some kind of insider trading.

I have already sold my shares in this company because I think I need to revise my idea of an asset play. Whether the market decided to act otherwise is not in my control nor my interest... I need to hold forth to my ideas stubbornly.

But I do have some views on insider trading.

Firstly, they are, definitely something we can do without, for it propagates the idea that in order to make a decent amount of money from the stock market, you need to have insider information. You can never eradicate insider trading with regulation...

Secondly, it takes some courage to act upon insider info. Let me explain.. for instance, an associate will advise me that company ABC is going to announce that they have secure a large project, and it is best to act upon it.

My first question will be: How big is this project? The second question will be: When will it happen?

It is also foolhardy to assume that the catalyst will happen within days. For instance, how would you felt if the price plunged by 1%, with a slightly larger than normal volume? Would you steadfastly held on? After all, technical analysis is about reading crowd emotion and by buying on insider information, you are influenced by a mere 1 person, how about more?

If a certain Mr Schloss could hide inside a small office, meet no management, and yet make plenty of money, why not?

Friday, September 9, 2016

And it falls...

After a couple of post about warning signs (as gleaned from William O'Neil's book about market topping off), the markets, without any warning, drop about 2.3-5 percent last night.

The book mentioned about market "stalling," which means neither having a clear up or down direction (in short, a doji), and increased volume over the previous day. This hints of institutional selling.

The market has already hit new heights since post-Brexit and investors should have taken care not to "pay a fair price for a good company," and insist on a good margin of safety.

The book mentioned about market "stalling," which means neither having a clear up or down direction (in short, a doji), and increased volume over the previous day. This hints of institutional selling.

The market has already hit new heights since post-Brexit and investors should have taken care not to "pay a fair price for a good company," and insist on a good margin of safety.

Thursday, September 1, 2016

Singtel

Singtel (SGX:Z74) shares declined to a price of 3.97 today, which somewhat brought attention to some investors. The man in the street might not know this but Singtel is the biggest company by market capitalization in Singapore. It is also generous with dividends.

I guess most investors are keen in Singtel for the dividends and not capital gains.

As you can see, Singtel's share price barely moves from 2009-2012 and then moves up another notch in 2013 and been such ever since.

That is the share price, let's take a look at earnings.

Year - Earnings Per Share (EPS) in cents

2016 - 24.26

2015 - 23.73

2014 - 22.87

2013 - 21.96

2012 - 24.97

2011 - 23.98

2010 - 24.46

2009 - 21.60

2008 - 24.76

2007 - 23.13

As you can see, EPS is largely the same over the last decade.

Singtel isn't the type of share that I will be interested in for a couple of good reasons

1) Largely no growth possibilities other than major M&A overseas.

2) No exciting new products.

3) A very large dividend payout ratio. It is paying out about 2.7 billion out of 3.8 billion of retained earnings in the last year. Below screen captured from Singtel's latest annual report...

Out of 3.870B of earnings, it is paying out 2.789B, which translate to a 72% payout.

I think a growing dividend is not possible with this type of company... a growing dividend usually translate to a growing share price as well. If you are looking to acquire Singtel for dividends, it will be a better bet than Starhub, that is for sure, having a way better debt to equity ratio and lower dividend payout.

I guess most investors are keen in Singtel for the dividends and not capital gains.

As you can see, Singtel's share price barely moves from 2009-2012 and then moves up another notch in 2013 and been such ever since.

That is the share price, let's take a look at earnings.

Year - Earnings Per Share (EPS) in cents

2016 - 24.26

2015 - 23.73

2014 - 22.87

2013 - 21.96

2012 - 24.97

2011 - 23.98

2010 - 24.46

2009 - 21.60

2008 - 24.76

2007 - 23.13

As you can see, EPS is largely the same over the last decade.

Singtel isn't the type of share that I will be interested in for a couple of good reasons

1) Largely no growth possibilities other than major M&A overseas.

2) No exciting new products.

3) A very large dividend payout ratio. It is paying out about 2.7 billion out of 3.8 billion of retained earnings in the last year. Below screen captured from Singtel's latest annual report...

Out of 3.870B of earnings, it is paying out 2.789B, which translate to a 72% payout.

I think a growing dividend is not possible with this type of company... a growing dividend usually translate to a growing share price as well. If you are looking to acquire Singtel for dividends, it will be a better bet than Starhub, that is for sure, having a way better debt to equity ratio and lower dividend payout.

Wednesday, August 31, 2016

Signs of Market Topping?

Here comes another possibly futile exercise in chart reading.

All four major indexs, the dows, s&p, nasdaq and nyse composite are showing signs of selling off with increase volume.

Perhaps, at the very least, it is time to take profits on stalwart or slow grower stocks, particular those that are on leverage.

All four major indexs, the dows, s&p, nasdaq and nyse composite are showing signs of selling off with increase volume.

Perhaps, at the very least, it is time to take profits on stalwart or slow grower stocks, particular those that are on leverage.

Monday, August 29, 2016

Notes from Chapter 5, "The Defensive Investor and Common Stock"

One of my favourite book is "The Intelligent Investor" and chapter 5 describe principles that a defensive investor (one who wish to be free from worry, in other words, passive) should look for.

4 rules were prescribed

The excellent commentary by Jason Zweig talks about the danger of "buying what you know" (made famous by Peter Lynch) without making the necessary research. Complacency in buying stocks, especially if it is something familiar to you, is nefarious as an investor.

DCA into index funds is stressed once again, as disciplined buying will enable one to have gains even during the worst bear market.

4 rules were prescribed

- Diversification of between 10-30 securities

- Companies involved should be large and modestly-financed. This means a certain amount of market capitalization and manageable debts

- A long record of dividend payments. 20 years might be a good start.

- PE of average earnings of less than 25, no more than 20 for the Trailing-Twelve-Months (TTM) PE. Note the term "average earnings." Earnings tend to fluctuate all the time, hence an average PE might make more sense especially when a company might have only 1 good year out of 5.

The excellent commentary by Jason Zweig talks about the danger of "buying what you know" (made famous by Peter Lynch) without making the necessary research. Complacency in buying stocks, especially if it is something familiar to you, is nefarious as an investor.

DCA into index funds is stressed once again, as disciplined buying will enable one to have gains even during the worst bear market.

Saturday, August 20, 2016

Calling Market Tops? I won't try.

Lying among my favored "The Intelligent Investor," "One Up on Wall Street," and many others is a book on momentum investing, "How to Make Money in Stocks" by the legendary William O'Neil. Mr O'Neil is a mentor to David Ryan, multiple winner of the U.S Investing Championship.

In summary, this book talks about

The 3 indexs, SP500, DJ and NASDAQ is lay down below:

I can only note that towards the end of July, the Nasdaq and DJ were inversely correlated.

On the whole, I could only point out 2-August as a possible red flag.

August 8-10 was extremely worrisome, but like how the market will often make a mockery of us, August 11 was a bullish movement.

Volume for the past two weeks wasn't spectacular, the last trading day, 19-Aug, was a typical hammer but there wasn't any discernible trend going on.

Predicting market movement is as tough as nails.

In summary, this book talks about

- various chart patterns that will lead to an explosive increase in prices (cup with handle, tight flag, etc)

- stocks that react accordingly usually have the attributes of C.A.N.S.L.I.M

The 3 indexs, SP500, DJ and NASDAQ is lay down below:

I can only note that towards the end of July, the Nasdaq and DJ were inversely correlated.

On the whole, I could only point out 2-August as a possible red flag.

August 8-10 was extremely worrisome, but like how the market will often make a mockery of us, August 11 was a bullish movement.

Volume for the past two weeks wasn't spectacular, the last trading day, 19-Aug, was a typical hammer but there wasn't any discernible trend going on.

Predicting market movement is as tough as nails.

Monday, August 1, 2016

Self Doubt

Very few of us can beat the index. Yet much of us spend a

lot of time analyzing companies, looking at stock charts and reading news, in

an effort to move closer to our goals.

Once, a dear friend asked me, “What is your investment

target?” I don’t have much positive traits but I think my honesty outweighs my

humility, and I replied that I simply have no idea.

I do not have a quantifiable target, nor do I have a

relative target. What that means is that I do not have a numerical target for

returns (i.e. “I want 15% returns this year!”), nor am I seeking a >2%

return better than the index.

I am only 10 months into this game and I am too early to set

a target. Even legendary investors have

years, at times consecutively, have lost to the index, or even worse, lost

money.

So why am I,

… son of labourers with no experience in investing,

… not financially trained (I had a diploma in a computing

field, and a degree in liberal arts),

… not in the finance industry

... a lowly paid

IT-support staff in a local university, with no insider knowledge in

the finance or financial education industry,

… having no dealings with people of finance or high social

standing

…doing in the

stock market?

There are numerous times that I questioned my investing

abilities.

“What if I am wrong?”

There are times earlier that I do capitulate and suffer from

“break-even-itis” (selling at break even prices and proceed to watch the stock

soar).

My friends had berated me for being negative. Will I able to

get a grip during a bear market?

Investing is a testy proposition. The stock market can taunt you,

rock your confidence, and sour your moods.

You can feel like the loneliest

person around.

Your friends will

question your intelligence.

You go home to your loved ones and wondered if you

can ever repay the faith or effort they have invest in you.

I can only have faith.

Tuesday, July 26, 2016

Undervalued Companies: By what definition?

By and large, there are 3 simple ways of describing a company as undervalued. To define the term undervalued would to say that the stock market is offering you, a buyer, a price that is worth less than what the company is worth, in 3 ways:

1) By assets

This involves looking at the balance sheet of the company and assessing if the composition of the assets are sound, versus the liabilities listed. This also involved looking at the Notes listed afterwards for hidden liabilities, which can be law suits, or even leased items that can generate huge costs.As most assets goes, usually the most "reliable assets" are ranked roughly as such,

i) Cash/Equivalents (bank deposits)

ii) Land/Property at cost

iii) Land/Property at fair value (market price, as valued by professional valuators)

iv) Accounts Receivable that are largely secured and not having a trend of increasing late payments, be it quantity or by days due.

The "unreliable assets" include

i) good will

ii) intangible assets

iii) assets classified as loans with dubiously high interest rate and/or unsecured.

iv) plants and equipment that are obsolete, or very little resale probability.

Catch: Companies who are human-capital intensive will fail to make the cut. Old companies with assets that are either depreciated (tangible assets) or amortized (intangible assets) will be screened out as well.

2) By Discounted Cash Flow valuation or sophisticated ways of quantitative valuation

Designed for companies with very consistent yearly cashflows and preferably consistent and low capital expenditures. The companies are assessed for its durable competitive advantage, which can be classified by

a) size of company in relative to competition

b) intangible/brand name assets that makes the end-user pay more solely for that.

c) unique access to a resource, either by geographical reasons or regulations.

d) high switching costs

An expected growth is computed for a defined number of years, and the total cash flow is discounted based on how risky the analyst think the company is. The number of cash generated is then divided by the amount of shares available and compared to the market price. If there is a significant difference in the favor of the buyer, this is constituted as "a margin of safety" and can be reliably purchased.

Catch:

a) Growth stocks will likely fail the cut, but discounted cash flow valuation is usually done by conservative investors anyway.

b) Companies who are by and large cyclical, that is, with earnings that are seasonal or project-based, will probably be hard to value.

If you are very lucky to get a company that is cheap based on (1) and (2), I regard that as a very safe purchase.

3) Cheap by Relative Valuation

By using this method, you are implicitly subscribing to this theory that the markets are always efficient, in that the market always price the stock correctly.The last type of "cheap" companies are companies that are relatively cheap by comparison.

This involves comparing the company with

a) Its peers in the same industry and comparing their

i) Price to sales

ii) Price to cash flow

or even iii) Price to book value.

b) Ranking the companies in a reliable Index, such as S&P 500, Straits Time Index, FTSE, etc, and sorting them by its Price-to-Earnings or even just by the loss in price. The last few companies are then examine for its business qualities and then purchase. The idea is that the worst performers usually do well in the future.

I think this approach might be testy, and a lazy investor may be hurt very badly. Also, the market can be right at times, and companies can fall off the index due to failing to make the index's required market capitalization. Companies who suffer this fate usually don't recover largely because institutional buyers who not be interested in these companies, for fear of reprimands when the purchase don't bode well.

This is my opinion of how stocks are generally regarded as cheap, and my favorite approach is (1) and (2).

Friday, July 15, 2016

The Stock Market as a Restaurant

If we were to imagine the stock exchange as a restaurant, where an investor's earnings equates to the satisfaction deriving from the quality of the food and the price paid for it, then

Investor Returns = Quality of Food divided by Price Paid for Food

When the restaurant enjoys a rip-roaring business due to hear-say, leading from "hear-says" from food bloggers (equities analyst who sets target prices), impossibly long queues from natives and tourists alike (speculators) are form.

It would be quite sensible to assume that the quality of food will drop when the restaurant is busy. After all, the chefs are faced with a growing list of tickets from the servers.The broth will be diluted.. the purchasing supervisor might be tempted to lower his/her standards and purchase lower quality food, and perhaps pile up on stock in case of shortages.

Investor Returns = Lower Quality of Food divided by Price Paid for Food

In response to the overwhelming patronage, the restaurant has no choice, possibly

due to greed or increases in variable costs, to raise prices (just like

how a stock's price is increase).

Investor Returns = Lower Quality of Food divided by Higher Price Paid for Food

Isn't it time to start cooking at home or to eat at another restaurant?

How many times have you queue for an hour and realize the food is only passable?

Wednesday, July 6, 2016

SGX Stockfact Screener and Hong Kong Land

I believe that you need very little capital expenditure to be a value investor. If someone like Seth Klarman does not have a Bloomberg terminal, simple, free and easily accessible tools online is usually enough.

Heck, even Walter Schloss depend on Valueline reports all his life, read annual reports and doesn't usually attend AGMs.

So one of the available screener is StockFacts. There are very little parameters available, and also a maximum of 4 parameters that you can set at any point of time.

If your appetite for risk is big, you can increase the market cap allowance to a minimum of even 1.3million (that is the market cap of the smallest stock in SGX).

I look for a dividend yield of at least 2%. Fix deposit rates lies at about 1.8% in Singapore, but it could be as low as 1.4% now. The whole idea is I want to be rewarded for waiting and holding stocks.

I don't have a fixation for any industry, but usually P/BV (Price over Book Value) stocks of 0.5 or less are currently property stocks, who are largely cyclical stocks. Cyclical refer to stocks that are highly value during good times and vice versa.

As you can see, companies that didn't see a dime of profits like Hyflux is screened. You can add a Price/Earning ratio and set it to 0.001 or some sort of value.

Right from the bat, I will take special notice of a few companies above.

Tiong Seng Holdings - Construction and Engineering... how good is its PE over the years? How valuable are the assets? A large value for PPE (Property, Plant and Equipment) is not desirable.

If dividends are important to you, www.dividends.sg will be indispensable. A check at this extremely valuable website reveals that Tiong Seng actually cut dividends over the years...

From the list of companies, one of them which I am keen in is Hong Kong Land, a subsidary wholly owned by the conglomerate Jardine Strategic Holdings.

It is also listed in STI, which brings about a great deal of liquidity and attention. Looking at its annual report, this company is so well regarded by bank. Most of its loans are unsecured.

This is the dividend history of HongKong Land:

http://www.dividends.sg/view/H78

Clicking on HongKong Land within Stockfacts bring you to this page where it throws up some past history of this large company. I am inclined to click on the "Download/Print" page which will display a nice 3-4 page PDF.

Selected items that I am interested in are:

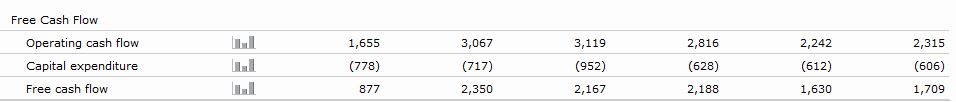

Consistent Cash Flows in Operations. I believe the large outflow of cash in FY2015 in financing is to service its debt. Hong Kong Land has an extremely strong balance sheet at the moment.

Payout ratio refers to the % of earnings it is paying as dividends. During the pre-2011 days, this company has fast-growing revenues. I can only assume at this moment that it is re-investing its profits for growth. As revenue growth slows, it is paying out a decent amount as dividends.

Who are the major shareholders?

I will only be worried in Jardine starts paring down ownership..

You will still need to read the annual report to understand the business. For its latest report in March, it appears that HKL is a property rental collector with large revenues from its rental in Greater China, particularly Hong Kong. Almost 70% of its income is from property investment. The rest is from property development, in which most of which are in China.

If you believe in the direction of this business, I think HKL is a worthy buy.

Will it pay off handsomely? Not really. But is it safe? Sure is.

Heck, even Walter Schloss depend on Valueline reports all his life, read annual reports and doesn't usually attend AGMs.

So one of the available screener is StockFacts. There are very little parameters available, and also a maximum of 4 parameters that you can set at any point of time.

If your appetite for risk is big, you can increase the market cap allowance to a minimum of even 1.3million (that is the market cap of the smallest stock in SGX).

I look for a dividend yield of at least 2%. Fix deposit rates lies at about 1.8% in Singapore, but it could be as low as 1.4% now. The whole idea is I want to be rewarded for waiting and holding stocks.

I don't have a fixation for any industry, but usually P/BV (Price over Book Value) stocks of 0.5 or less are currently property stocks, who are largely cyclical stocks. Cyclical refer to stocks that are highly value during good times and vice versa.

As you can see, companies that didn't see a dime of profits like Hyflux is screened. You can add a Price/Earning ratio and set it to 0.001 or some sort of value.

Right from the bat, I will take special notice of a few companies above.

Tiong Seng Holdings - Construction and Engineering... how good is its PE over the years? How valuable are the assets? A large value for PPE (Property, Plant and Equipment) is not desirable.

If dividends are important to you, www.dividends.sg will be indispensable. A check at this extremely valuable website reveals that Tiong Seng actually cut dividends over the years...

From the list of companies, one of them which I am keen in is Hong Kong Land, a subsidary wholly owned by the conglomerate Jardine Strategic Holdings.

It is also listed in STI, which brings about a great deal of liquidity and attention. Looking at its annual report, this company is so well regarded by bank. Most of its loans are unsecured.

This is the dividend history of HongKong Land:

http://www.dividends.sg/view/H78

Clicking on HongKong Land within Stockfacts bring you to this page where it throws up some past history of this large company. I am inclined to click on the "Download/Print" page which will display a nice 3-4 page PDF.

Selected items that I am interested in are:

Consistent Cash Flows in Operations. I believe the large outflow of cash in FY2015 in financing is to service its debt. Hong Kong Land has an extremely strong balance sheet at the moment.

Payout ratio refers to the % of earnings it is paying as dividends. During the pre-2011 days, this company has fast-growing revenues. I can only assume at this moment that it is re-investing its profits for growth. As revenue growth slows, it is paying out a decent amount as dividends.

Who are the major shareholders?

I will only be worried in Jardine starts paring down ownership..

You will still need to read the annual report to understand the business. For its latest report in March, it appears that HKL is a property rental collector with large revenues from its rental in Greater China, particularly Hong Kong. Almost 70% of its income is from property investment. The rest is from property development, in which most of which are in China.

If you believe in the direction of this business, I think HKL is a worthy buy.

Will it pay off handsomely? Not really. But is it safe? Sure is.

SGX Stockfact Screener and Hong Kong Land USD

I believe that you need very little capital expenditure to be a value investor. If someone like Seth Klarman does not have a Bloomberg terminal, simple, free and easily accessible tools online is usually enough.

Heck, even Walter Schloss depend on Valueline reports all his life, read annual reports and doesn't usually attend AGMs.

So one of the available screener is StockFacts. There are very little parameters available, and also a maximum of 4 parameters that you can set at any point of time.

If your appetite for risk is big, you can increase the market cap allowance to a minimum of even 1.3million (that is the market cap of the smallest stock in SGX).

I look for a dividend yield of at least 2%. Fix deposit rates lies at about 1.8% in Singapore, but it could be as low as 1.4% now. The whole idea is I want to be rewarded for waiting and holding stocks.

I don't have a fixation for any industry, but usually P/BV (Price over Book Value) stocks of 0.5 or less are currently property stocks, who are largely cyclical stocks. Cyclical refer to stocks that are highly value during good times and vice versa.

As you can see, companies that didn't see a dime of profits like Hyflux is screened. You can add a Price/Earning ratio and set it to 0.001 or some sort of value.

Right from the bat, I will take special notice of a few companies above.

Tiong Seng Holdings - Construction and Engineering... how good is its PE over the years? How valuable are the assets? A large value for PPE (Property, Plant and Equipment) is not desirable.

If dividends are important to you, www.dividends.sg will be indispensable. A check at this extremely valuable website reveals that Tiong Seng actually cut dividends over the years...

From the list of companies, one of them which I am keen in is Hong Kong Land, a subsidary wholly owned by the conglomerate Jardine Strategic Holdings.

It is also listed in STI, which brings about a great deal of liquidity and attention. Looking at its annual report, this company is so well regarded by bank. Most of its loans are unsecured.

This is the dividend history of HongKong Land:

http://www.dividends.sg/view/H78

Clicking on HongKong Land within Stockfacts bring you to this page where it throws up some past history of this large company. I am inclined to click on the "Download/Print" page which will display a nice 3-4 page PDF.

Selected items that I am interested in are:

Consistent Cash Flows in Operations. I believe the large outflow of cash in FY2015 in financing is to service its debt. Hong Kong Land has an extremely strong balance sheet at the moment.

Payout ratio refers to the % of earnings it is paying as dividends. During the pre-2011 days, this company has fast-growing revenues. I can only assume at this moment that it is re-investing its profits for growth. As revenue growth slows, it is paying out a decent amount as dividends.

Who are the major shareholders?

I will only be worried in Jardine starts paring down ownership..

You will still need to read the annual report to understand the business. For its latest report in March, it appears that HKL is a property rental collector with large revenues from its rental in Greater China, particularly Hong Kong. Almost 70% of its income is from property investment. The rest is from property development, in which most of which are in China.

If you believe in the direction of this business, I think HKL is a worthy buy.

Will it pay off handsomely? Not really. But is it safe? Sure is.

Heck, even Walter Schloss depend on Valueline reports all his life, read annual reports and doesn't usually attend AGMs.

So one of the available screener is StockFacts. There are very little parameters available, and also a maximum of 4 parameters that you can set at any point of time.

If your appetite for risk is big, you can increase the market cap allowance to a minimum of even 1.3million (that is the market cap of the smallest stock in SGX).

I look for a dividend yield of at least 2%. Fix deposit rates lies at about 1.8% in Singapore, but it could be as low as 1.4% now. The whole idea is I want to be rewarded for waiting and holding stocks.

I don't have a fixation for any industry, but usually P/BV (Price over Book Value) stocks of 0.5 or less are currently property stocks, who are largely cyclical stocks. Cyclical refer to stocks that are highly value during good times and vice versa.

As you can see, companies that didn't see a dime of profits like Hyflux is screened. You can add a Price/Earning ratio and set it to 0.001 or some sort of value.

Right from the bat, I will take special notice of a few companies above.

Tiong Seng Holdings - Construction and Engineering... how good is its PE over the years? How valuable are the assets? A large value for PPE (Property, Plant and Equipment) is not desirable.

If dividends are important to you, www.dividends.sg will be indispensable. A check at this extremely valuable website reveals that Tiong Seng actually cut dividends over the years...

From the list of companies, one of them which I am keen in is Hong Kong Land, a subsidary wholly owned by the conglomerate Jardine Strategic Holdings.

It is also listed in STI, which brings about a great deal of liquidity and attention. Looking at its annual report, this company is so well regarded by bank. Most of its loans are unsecured.

This is the dividend history of HongKong Land:

http://www.dividends.sg/view/H78

Clicking on HongKong Land within Stockfacts bring you to this page where it throws up some past history of this large company. I am inclined to click on the "Download/Print" page which will display a nice 3-4 page PDF.

Selected items that I am interested in are:

Consistent Cash Flows in Operations. I believe the large outflow of cash in FY2015 in financing is to service its debt. Hong Kong Land has an extremely strong balance sheet at the moment.

Payout ratio refers to the % of earnings it is paying as dividends. During the pre-2011 days, this company has fast-growing revenues. I can only assume at this moment that it is re-investing its profits for growth. As revenue growth slows, it is paying out a decent amount as dividends.

Who are the major shareholders?

I will only be worried in Jardine starts paring down ownership..

You will still need to read the annual report to understand the business. For its latest report in March, it appears that HKL is a property rental collector with large revenues from its rental in Greater China, particularly Hong Kong. Almost 70% of its income is from property investment. The rest is from property development, in which most of which are in China.

If you believe in the direction of this business, I think HKL is a worthy buy.

Will it pay off handsomely? Not really. But is it safe? Sure is.

Monday, June 27, 2016

Post-Brexit updates, and small thoughts about Noble, Keppel and Yoma.

The Brexit pessimism sold down markets heavily. There is an old saying that cheap becomes cheaper.

While it is necessary to keep a positive frame of mind that markets will eventually recover, one should not forget the fact that a correction doesn't equates that all stocks are cheap now. The need to have some basic fundamental knowledge and control over one's emotion is applicable at these times.

By that I mean selling in panic, or buying in a frenzy.

I have been keen in quite a few companies lately, especially after they have gone into trouble. I guess it will help to discuss them briefly here

Noble

Clearly they are in debt and tons of trouble. But raising equity via such a heavy rights issue is a major deal-breaker for me. I guess what I can take away from reading Peter Lynch's One Up on Wall Street is that companies usually turnaround successfully from diluting shareholder's equity but the end-result usually wouldn't reward shareholders in the end.

There are better bets out there especially when your capital is as limited as mine.

Keppel Group

Keppel is a conglomerate and they want you to know that.. especially when their cashflow is severely affected by their Offshore and Marine (O&M) division. Revenues are contributed mostly by O&M and Property, and this is the first time in 3 years that property contributed more $ to Keppel than O&M.

Hence about 5,000 employees in O&M lost their jobs this year. Interesting enough, manpower cost remains the same for the last three years. I have no idea why this has come to pass and I hope shareholders asked during the AGM.

I have no idea how to value Keppel as it is a cyclical company. However I have faith that this company will definitely not go belly up as its major shareholder is Temasek Holdings. This does not mean that shareholders will lose capital (Remember NOL?).

Price of shares follows earnings in the long run. The question is whether Keppel is nicely priced at 5.2x? I have no idea. Its free cash flow is extremely volatile. But no worries about the dividend pay out and whether the company has shareholders' interest at heart. They paid 40 odd percent of retained earnings to sharehodlers in 2014, and paid 50% this year. I don't think dividends will suffer too much.

It is also vague in whether the 230million provisions for Sete Brasil's unsold rigs is enough. I have not scrutinized the report yet, though.

Yoma Strategic Holdings

I can't read annual reports off the screen, and I paid some printer almost 9 SGD for this report to be printed... but before I can finish half of the report, I am already put off by loans extended to customers. Hence I doubt I will be investing in this company. The introduction of his son as the CEO is no problem but it seems like an abrupt decision to me.

I intend to look elsewhere.

While it is necessary to keep a positive frame of mind that markets will eventually recover, one should not forget the fact that a correction doesn't equates that all stocks are cheap now. The need to have some basic fundamental knowledge and control over one's emotion is applicable at these times.

By that I mean selling in panic, or buying in a frenzy.

I have been keen in quite a few companies lately, especially after they have gone into trouble. I guess it will help to discuss them briefly here

Noble

Clearly they are in debt and tons of trouble. But raising equity via such a heavy rights issue is a major deal-breaker for me. I guess what I can take away from reading Peter Lynch's One Up on Wall Street is that companies usually turnaround successfully from diluting shareholder's equity but the end-result usually wouldn't reward shareholders in the end.

There are better bets out there especially when your capital is as limited as mine.

Keppel Group

Keppel is a conglomerate and they want you to know that.. especially when their cashflow is severely affected by their Offshore and Marine (O&M) division. Revenues are contributed mostly by O&M and Property, and this is the first time in 3 years that property contributed more $ to Keppel than O&M.

Hence about 5,000 employees in O&M lost their jobs this year. Interesting enough, manpower cost remains the same for the last three years. I have no idea why this has come to pass and I hope shareholders asked during the AGM.

I have no idea how to value Keppel as it is a cyclical company. However I have faith that this company will definitely not go belly up as its major shareholder is Temasek Holdings. This does not mean that shareholders will lose capital (Remember NOL?).

Price of shares follows earnings in the long run. The question is whether Keppel is nicely priced at 5.2x? I have no idea. Its free cash flow is extremely volatile. But no worries about the dividend pay out and whether the company has shareholders' interest at heart. They paid 40 odd percent of retained earnings to sharehodlers in 2014, and paid 50% this year. I don't think dividends will suffer too much.

It is also vague in whether the 230million provisions for Sete Brasil's unsold rigs is enough. I have not scrutinized the report yet, though.

Yoma Strategic Holdings

I can't read annual reports off the screen, and I paid some printer almost 9 SGD for this report to be printed... but before I can finish half of the report, I am already put off by loans extended to customers. Hence I doubt I will be investing in this company. The introduction of his son as the CEO is no problem but it seems like an abrupt decision to me.

I intend to look elsewhere.

Wednesday, June 15, 2016

Time to Watch by the Sidelines?

This will be a really short post.

When I started investing, I frequently look at stocks trading at 52-weeks low. I have been doing it frequently from BarChart 52-weeks low, looking at its balance sheet and thinking if it makes a good turnaround bet. I had a few success in spotting these stocks but unfortunately, I wasn't confident in my abilities then, and watch stocks like Spartan Motors (SPAR), and MidSouth Bancorp go as high as 100%.

Such a practice can be pretty robotic, getting the list, and looking at its balance sheet quickly. It has been a while since I did that though, and I was very surprised today.

And today, there is really only a handful of stocks, regardless of market capitalization, that is trading at 52 weeks' low, and that smells like the market could possibly be overly optimistic.

I don't know about you, but I very much prefer to stand by the side of the court and wait.

While it is usually better to be vested most of the time, I think it might be prudent to lay hands off the American market. I still vested in SGX, in stocks that I find that are cheap.

Hopefully it will pay off in the long term.

When I started investing, I frequently look at stocks trading at 52-weeks low. I have been doing it frequently from BarChart 52-weeks low, looking at its balance sheet and thinking if it makes a good turnaround bet. I had a few success in spotting these stocks but unfortunately, I wasn't confident in my abilities then, and watch stocks like Spartan Motors (SPAR), and MidSouth Bancorp go as high as 100%.

Such a practice can be pretty robotic, getting the list, and looking at its balance sheet quickly. It has been a while since I did that though, and I was very surprised today.

And today, there is really only a handful of stocks, regardless of market capitalization, that is trading at 52 weeks' low, and that smells like the market could possibly be overly optimistic.

I don't know about you, but I very much prefer to stand by the side of the court and wait.

While it is usually better to be vested most of the time, I think it might be prudent to lay hands off the American market. I still vested in SGX, in stocks that I find that are cheap.

Hopefully it will pay off in the long term.

Sunday, June 12, 2016

A Little Talk about My Portfolio

Primary Holdings

Sim Lian Group

Sim Lian Group is a respectable property developer that is purchased because I believe it is trading at a huge discount to its cashflow. The dividend yield is very high at the moment-- which is deceiving because the yield is derived from a special bonus last year.The biggest reason why this company is a little different from other small-scaled property developers-- check out the board members and you will know what I mean. I leave the fun to you..

Capitaland Commerical Trust

The stock is trading at a significant discount to its net asset value. Recently they have acquired the whole of CapitaGreen and is expecting it to be accretive for shareholders. This bring debt-to-equity at 37%, which is not all that bad.The property yield of CCT is actually weaker than Fraser Commerical Trust, but on the whole the quality of CCT's properties is higher, so I am not so concerned. Holding on to my paper losses at the moment and waiting for a good chance to average down.

Secondary Holdings

VICOM

A needless fear among investors for this stock, which is down-trending. The main rationale for buying this stock is for the quality of its dividends. When a friend of mine draw attention to me about it trading at 52-week low, I took up a small position without much consideration.Singapore Shipping Company

Small company, some debts, decent cashflow, but single-customer. Based on cashflow over the years, it is considered cheap at 0.27x and but there are some concerns with its business fundamentals, namely an inexperienced CEO (family business, ahem), and single-customer risk.DBS

DBS was purchased because it is trading at 0.9x book value. Not one of my proudest purchase since I did very little homework. It is a easy one to make since this is Singapore's biggest and one of Asia's biggest. I don't expect terrific gains.UOL

Trading at below book value and strong management. Even if Mr. Wee leaves the business, it will still go on strongly. However, the rental and property developing business is facing headwinds regionally, and earnings should remain suppressed. I have taken up a small position just in case the price becomes more favorable, and I can build on my position.Sing Holdings

With the latest quarter report, it appears that Sing Holdings is now debt-free, but have a variable asset in Account Receivables and unsold properties. It will be very interesting to see what it does for the rest of the year. Any company that is debt-free and a 0.5 book value per share should be quite safe for long term holding.Small Holdings

Ascendas Hospitality Trust

This stock is trading at below book value. It has a pretty patchy property yield as the trust is still so young (property accumulation stage), so the dividends should offset some risk. Staying vested and waiting on the side lines for a change in its story.CapitaMall Trust

This company's property yield is extremely impressive but it is trading at a significant price over book value. I will add on to my position should fear take over the market again, as it was with much regret that I did not partake in this during this Feb's great correction. I am eager to make this one of my main holdings.Sunday, June 5, 2016

One Up on Wall Street- A Short Review

I have just completed my first reading of Peter Lynch's classic text, "One Up on Wall Street," recently.

While the contents of this book is extremely palatable, it contains very little technical information and little is mentioned about valuation. I am a little amused because while this book is easily understandable, it should be best read by someone who had a look at more technical books such as "5 Rules to Successful Stock Investing."

The danger is that Mr Lynch made it sound too easy.

There are of course good takeaways from this book, such as classifying companies into 6 different categories, which are:

For e.g. assuming a stock like GSK, who is paying excellent dividends but isn't growing rapidly (a slow grower), started to fail in paying a dividend, that will be cause for concern.

An asset play that has its property valued down recently could also be cause for concern.

As with most books I think it is worthwhile to re-read them a couple of times to digest the concepts fully, and I am in the process of doing so.

Peter Lynch's One up on Wall Street in Book Depository

While the contents of this book is extremely palatable, it contains very little technical information and little is mentioned about valuation. I am a little amused because while this book is easily understandable, it should be best read by someone who had a look at more technical books such as "5 Rules to Successful Stock Investing."

The danger is that Mr Lynch made it sound too easy.

There are of course good takeaways from this book, such as classifying companies into 6 different categories, which are:

- Turnarounds- Stocks like Noble who are issuing new shares would be frown upon by Peter Lynch as they usually does not bode well for investors in the long run.

- Slow Growers- usually dividend stocks. Various REITs, ST Engineering comes to mind. This company desperately need a breakthrough of some sorts to increase revenues

- Fast Growers- Best World, who is expanding into China, have a sizable market to grow at.

- Stalwarts- Apple could be deem as a stalwart, but I thinking of DBS when it comes to local markets

- Cyclicals- Property Developers, Keppel, Sembcorp Marine. Times are bad now, but things will definitely be better if their balance sheet remains healthy. Basically cyclical companies generate tons of revenues during good times.

- Asset Plays- Stocks that are the proverbial "50cents for a dollar." Could be as simple as cash (Sing Holdings, possibly), property (SMRT with its many malls) , or companies holding equities of well-to-do equities (Yahoo comes in mind).

For e.g. assuming a stock like GSK, who is paying excellent dividends but isn't growing rapidly (a slow grower), started to fail in paying a dividend, that will be cause for concern.

An asset play that has its property valued down recently could also be cause for concern.

As with most books I think it is worthwhile to re-read them a couple of times to digest the concepts fully, and I am in the process of doing so.

Peter Lynch's One up on Wall Street in Book Depository

Wednesday, May 25, 2016

Beliefs to Hold Dear During a Bull Market

Business doesn't change from week to week.

When prices goes up, so does the risk.

When prices goes up, it doesn't necessarily reflect on the credibility of the company, nor the reliability of its earnings.

Good times will follow bad times; just like bad times will be succeed by good times. Nothing last forever.

Bulls do charge slower than a bear slide-- investors, like any human beings, prefer cash in the hand over unrealized profits (and certainly unrealized loss!!!).

Will the economy do well? Your guess is as bad as anyone's.

And finally, debts don't disappear during a bull market.

Invest wisely.

This too shall pass.

Monday, May 23, 2016

ISR Capital, A Ticking Timebomb?

In Oct 2013, three companies, Liongold, Blumont and Asiaons crash after a heavenly ascent of 800% within months, and crashed. Within 3 days, 8 billion worth of capital evaporated.

The MD of ISR Capital, Datuk Md Wira Dani Bin Abdul Daim, is the son of ex-Finance Minister of Malaysia, Tun Daim Zainuddin. He was also involved in Liongold, being its Executive Deputy Chairman. The CEO is Quah Su-Yin. Thanks to Google, you can find out if they are truly reputable or trustworthy.

So who are the major shareholders?

You can download their annual report from http://www.isrcap.com/attachment/201605041716311781353157_en.pdf or from SGX (which is the preferred choice).

Both Datuk Jared Lim Chih Li and Mr Ng Teck Wah were involved in the penny stock crash of 2013, under Asiason Capital (which is renamed ISR Capital!)

http://business.asiaone.com/news/were-not-bunch-cowboys

Seems like a tightly knitted group if you ask me. All of the investment companies listed appears to be related to one another, with no reputable outsiders vested (or trusting) this company.

Assuming you are not interested in the history of a company's board members nor its senior management, have a look at the annual report.

Auditor's Statement

In short, the auditors' statement is the only portion written by the auditors.

The last 3 paragraphs are important-- it tells us that investigation is on-going, and there is an uncertainty involved with this company.

The Revenue

The company booked a revenue of almost 3 million compared to a paltry sum of 131,000 the year before. How could a company made such ridiculously high improvements within a year?The ROE and ROA were -500++% and -300++% the year before, and now we have 22.2% and 11.6%?

If we look under note 4, the company claims that it makes the entire revenue from consultancy, with only about 70,000SGD from interest income from debt securities. There are no further breakdown on revenue.

The company's segment information, on page 119, said that the company's main operation are split to

The Balance Sheet

This is the craziest part of this company

Let's look at current assets, which means assets that can be convert to cash within 1 year.

This company has only 20k of cash, and bulk of the assets (3million) comes from Trade Receivables. Which means sums that is owe to them by customers.

Note 13 (page 89) reveals

Note 14 shows you that in the past year, 30M was owe but 27M is already impaired. Erm...

The true entertainment comes from Non-Current Assets, Debt Securities, which contribute to 2.2M of the balance sheet. Under note 18, it says

The MD of ISR Capital, Datuk Md Wira Dani Bin Abdul Daim, is the son of ex-Finance Minister of Malaysia, Tun Daim Zainuddin. He was also involved in Liongold, being its Executive Deputy Chairman. The CEO is Quah Su-Yin. Thanks to Google, you can find out if they are truly reputable or trustworthy.

So who are the major shareholders?

You can download their annual report from http://www.isrcap.com/attachment/201605041716311781353157_en.pdf or from SGX (which is the preferred choice).

Both Datuk Jared Lim Chih Li and Mr Ng Teck Wah were involved in the penny stock crash of 2013, under Asiason Capital (which is renamed ISR Capital!)

http://business.asiaone.com/news/were-not-bunch-cowboys

Seems like a tightly knitted group if you ask me. All of the investment companies listed appears to be related to one another, with no reputable outsiders vested (or trusting) this company.

Assuming you are not interested in the history of a company's board members nor its senior management, have a look at the annual report.

Auditor's Statement

Emphasis of matter

We draw your attention to Note 34 to the financial statements, which states that in April 2014, the Company with five of its wholly owned subsidiaries (one of which has since been disposed of), and two funds (including two subsidiaries of one of the funds) managed by the subsidiary of the Company that has since been disposed of, were served notices by the Commercial Affairs Department of the Singapore Police Force (“CAD”) for an investigation into an offence under the Securities and Futures Act, Chapter 289 (“SFA”). In the notices, the Company and those entities were asked to provide certain information pursuant to an investigation to be conducted by the CAD.

On 4 February 2015, the CAD confirmed to us that their investigation is still ongoing. As informed by the Board, apart from certain key personnel being requested to attend further interviews by the CAD in 2015, there have been no further new developments in the ongoing investigations.

In view of the above, there exist a material uncertainty, whether the ongoing investigation, the outcome of which is unknown, may have an impact on the Group’s ongoing business operations. Accordingly, the extent of adjustments, if any, that may arise from the ongoing investigations, may have an effect on the financial statements of the Group and the Company for the financial year ended 31 December 2015 and preceding years, if any.

Our opinion is not qualified in respect of this matter.The contents of an annual report are prepared by the company in question, not the auditor(s). The auditors' role is to audit the contents and give an opinion, as well as write the auditor statements produced on page 39 of the annual report.

In short, the auditors' statement is the only portion written by the auditors.

The last 3 paragraphs are important-- it tells us that investigation is on-going, and there is an uncertainty involved with this company.

The Revenue

The company booked a revenue of almost 3 million compared to a paltry sum of 131,000 the year before. How could a company made such ridiculously high improvements within a year?The ROE and ROA were -500++% and -300++% the year before, and now we have 22.2% and 11.6%?

If we look under note 4, the company claims that it makes the entire revenue from consultancy, with only about 70,000SGD from interest income from debt securities. There are no further breakdown on revenue.

The company's segment information, on page 119, said that the company's main operation are split to

- consultancy (IPOs?)

- investment management (no revenues recorded this year!?)

The Balance Sheet

This is the craziest part of this company

Let's look at current assets, which means assets that can be convert to cash within 1 year.

This company has only 20k of cash, and bulk of the assets (3million) comes from Trade Receivables. Which means sums that is owe to them by customers.

Note 13 (page 89) reveals

- about 3.171M of receivables

- After impairment (which means probably, not going to get these sums), it stands at 2.8M

- Amount already due by less than 90 days, the full sum of 2.8

- Page 90 says

These receivables are not secured by any collateral or credit enhancements.

Which means, this company is screwed if those "customers" don't pay!

Note 14 shows you that in the past year, 30M was owe but 27M is already impaired. Erm...

The true entertainment comes from Non-Current Assets, Debt Securities, which contribute to 2.2M of the balance sheet. Under note 18, it says

A debt facility with a principal amount of S$2,350,000 has been extended to a third party in 2015 for a period of five years. Interest is charged at 12% per annum with a 5% arrangement fee deducted upfront at each disbursement. The effective interest rate is computed at 13.4%.

What kind of rubbish credit rating is this 3rd party that will necessitate it taking a loan of 12% per annum? And the next paragraph says:

The debt facility could be drawn down by the third party for up to S$5,000,000 with maturity due 2020. The undrawn balance as at 31 December 2015 was S$2,650,000

It is telling you: This 3rd part can borrow from us another 2.65M.

This is exciting because I don't think ISR has that capital.

What can probably happen is that this mysterious 3rd party can keep borrowing from ISR Capital, as long as ISR keep issuing new shares, and then ISR can write off these "bad" debts?

And it is already happening. Look at Note 22

CONVERTIBLE REDEEMABLE BONDS

The proposed issuance of 2% convertible redeemable bonds due 2018 (the “Bonds”) with an aggregate principal amount of up to S$35,000,000 comprising seven tranches of bonds was approved by shareholders at an Extraordinary General

Meeting held on 8 September 2015. Each tranche comprises five equal sub-tranches of S$1,000,000 each. S$3,000,000 of the Tranche 1 Bonds were issued in September and October 2015. As at 31 December 2015, Bonds with a face value of S$750,000 have been converted into 187,500,000 ordinary shares. The present value of the Bonds after conversion amounted to S$2,053,672, which was arrived at using 5.5% per annum, an average rate compiled from interest rate quotations of 10 leading banks and financial institutions. The Bonds that remained outstanding as at 31 December 2015 were subjected to an interest rate of 2% per annum, payable in arrears on 31 December in 2015. Please refer to Note 20 for bond interest payable as at 31 December 2015.

As at 31 December 2015, the Company allocated approximately S$2,200,000 for investments in debt securities and approximately S$480,000 for general working capital (such as payment of remuneration of directors and employees, office rentals, insurance premiums and professional fees).

Stay away from this company.

As of writing, this stock has gain another 10% or so in a single day. Just because the price goes up, doesn't mean that the company is doing well. For those speculating, do question yourself on the ethical aspects.

As of writing, this stock has gain another 10% or so in a single day. Just because the price goes up, doesn't mean that the company is doing well. For those speculating, do question yourself on the ethical aspects.

Friday, May 20, 2016

Investment Rudder