You might have heard this line somewhere: value investing is a relatively simple concept but it is also the toughest to execute. Many pointed out that having a contrarian mindset is necessary, and I do feel this is only partially true.

Warren Buffett once said that "the idea of buying dollar bills for 40 cents take immediately with people or it doesn't take at all. It is like an inoculation. If it doesn't grab a person right away, i find that you can talk to him for years and show him records, and it doesn't make any difference. They just don't seem able to grasp the concept, simple as it is." (The Super-Investors of Graham-and-Doddsville)

I think this is largely due to a person's character which is either genetically inherited or moulded by the environment... and no amount of schooling might be sufficient to change one's attitude.

1) Healthy Respect for Money

Money is much easier to lose than keep. This is the main reason why value investors are usually natural savers, and why we tend to look down (at the potential risks) than up (rewards, or price up-side).

2) Objectivity and an Open Mind

You should be willing to assess any investment objectively. The company that is having tons of trouble in the news could be the next perfect opportunity. If you have problems discussing the strengths of your enemies among your peers, you might not be suitable to invest with a value approach.

3) Self-confidence, not Arrogance

Arrogance is believing that you are the best and are right at all times. Self confidence is having done the work, believing that you are right but having a healthy amount of self-doubt to check and re-check.

4) Toughness

Be ready to hold on to your beliefs even if the market adjust the price of your investment by 20-40%. One could argue that this mindset can deepen your losses (Bill Ackman's Herbalife short positions and Bruce Berkowitz's Sears comes to mind)

5) Be really optimistic; Bad times don't last

Pretty self-explanatory.

Pages

Search This Blog

Friday, August 31, 2018

Sunday, August 26, 2018

Investing by the Numbers (Book Value)

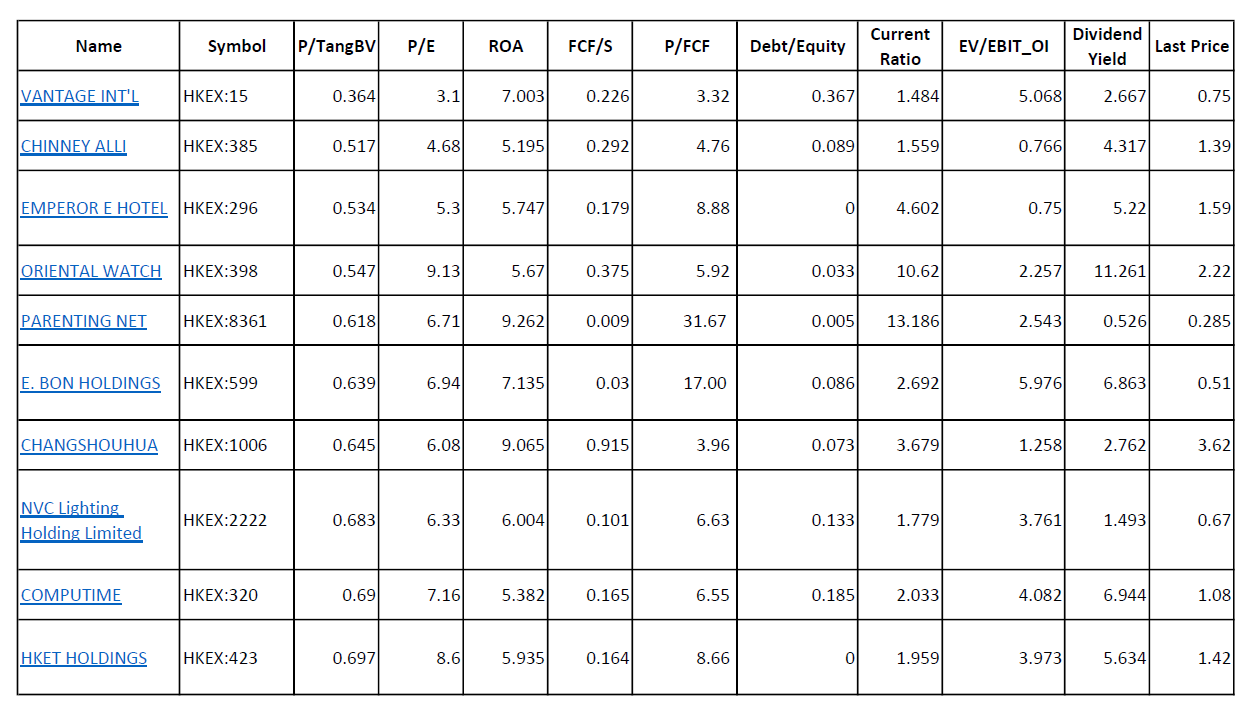

It would be pretty interesting to select 10 stocks, based on a few parameters and see how they fare in 6 months, 1 year, and then 2 years from now.

These stocks have the following:

a) a book value of less than 70 cents to a dollar

b) less than 50 cents of debt for every 1 dollar of equity

c) less than 8 times of operating income compared to its enterprise value (market cap - cash + debt).

d) current ratio > 1.5

The following stocks were generated by stock.cafe, and are pure HKEX plays. I think dividends should be taken into account. Can these stocks beat the index (Hang Seng Index).

As of now, the Hang Seng Index stands at 28,232.99 points. We will explore the results next year 27-Feb-2019.

These stocks have the following:

a) a book value of less than 70 cents to a dollar

b) less than 50 cents of debt for every 1 dollar of equity

c) less than 8 times of operating income compared to its enterprise value (market cap - cash + debt).

d) current ratio > 1.5

The following stocks were generated by stock.cafe, and are pure HKEX plays. I think dividends should be taken into account. Can these stocks beat the index (Hang Seng Index).

As of now, the Hang Seng Index stands at 28,232.99 points. We will explore the results next year 27-Feb-2019.

Recommend Books Part Two (Essential Readings)

Leading up to the third anniversary of my investing journey, I think an update on recommended study materials is appropriate.

I am still a firm believer of self studying. Investing is not just financial rewarding but intellectually stimulating-- a perpetual treasure hunt.

1. The 5 Rules to Successful Stock Investing

There is not a better book out there (afaik) that explains the financial statements using the simplest of examples: running a hot dog stand. If you know nothing about reading simple accounting stuff, get this book. It will probably take you half a month to finish half of this book.

2. The Intelligent Investor

The writing style and examples used in the text isn't contemporary, but even reading the summaries written by Jason Zweig (latest edition in 2006 covered the melt down in tech meltdown in 2000) will help prevent losses.

As a value investor, we should check the downside and risks instead of the upside-- losing money is often easier than winning.

3. One Up on Wall Street

While this book can serve as a wonderful introduction to investing, it appeals to investors with slight investing experience (such as myself) with little gems like market timing (or why it shouldn't bother you), portfolio management, story checking, etc. Peter Lynch's classification of companies into six different categories is popularly used in the investment circle.

You might be keen on "Beating the Street" by the same author as well.

4. Financial Shenanigans

There are a million and one way for management to commit frauds. One should do one's best to check the numbers... This book will help.

5. You Can be a Stock Market Genius

While it lacks a serious title, this book changes the way I look at unconventional investment opportunities. If you are a fan of the Buffett Partnership, its investments were classified into three categories: Generals, Controls and Workouts. General refers to companies which are undervalued by the market, and after buying enough shares available to control the company, they become part of the Controls group.

The last section, called Workouts, refer to investments which does not move with the general market direction. These are special situations (as termed in book #2) which no doubt lower investment portfolio during a bull market, but greatly provide relief during a bear one. This book deals with Workouts, but even if your portfolio consist mostly of it, it will provide highly satisfying returns.

The same author wrote this book call "The Little Book that still Beats the Market." Another highly entertaining book as well.

6. The Dhando Investor

If you are determined to be a value investor, this book could be priceless. What is the difference between risk and uncertainty?

That is all. You will spend an approximate six months to a year reading all of the above, but re-reading them is not only necessary, but entertaining.

I am still a firm believer of self studying. Investing is not just financial rewarding but intellectually stimulating-- a perpetual treasure hunt.

1. The 5 Rules to Successful Stock Investing

There is not a better book out there (afaik) that explains the financial statements using the simplest of examples: running a hot dog stand. If you know nothing about reading simple accounting stuff, get this book. It will probably take you half a month to finish half of this book.

2. The Intelligent Investor

The writing style and examples used in the text isn't contemporary, but even reading the summaries written by Jason Zweig (latest edition in 2006 covered the melt down in tech meltdown in 2000) will help prevent losses.

As a value investor, we should check the downside and risks instead of the upside-- losing money is often easier than winning.

3. One Up on Wall Street

While this book can serve as a wonderful introduction to investing, it appeals to investors with slight investing experience (such as myself) with little gems like market timing (or why it shouldn't bother you), portfolio management, story checking, etc. Peter Lynch's classification of companies into six different categories is popularly used in the investment circle.

You might be keen on "Beating the Street" by the same author as well.

4. Financial Shenanigans

There are a million and one way for management to commit frauds. One should do one's best to check the numbers... This book will help.

5. You Can be a Stock Market Genius

While it lacks a serious title, this book changes the way I look at unconventional investment opportunities. If you are a fan of the Buffett Partnership, its investments were classified into three categories: Generals, Controls and Workouts. General refers to companies which are undervalued by the market, and after buying enough shares available to control the company, they become part of the Controls group.

The last section, called Workouts, refer to investments which does not move with the general market direction. These are special situations (as termed in book #2) which no doubt lower investment portfolio during a bull market, but greatly provide relief during a bear one. This book deals with Workouts, but even if your portfolio consist mostly of it, it will provide highly satisfying returns.

The same author wrote this book call "The Little Book that still Beats the Market." Another highly entertaining book as well.

6. The Dhando Investor

If you are determined to be a value investor, this book could be priceless. What is the difference between risk and uncertainty?

That is all. You will spend an approximate six months to a year reading all of the above, but re-reading them is not only necessary, but entertaining.

Thursday, August 23, 2018

Complete Divestment of Playmate Holdings; Rethinking my approach

I have divested my shares in Playmates Holdings (HKEX: 635). Over the months since Jan, I am slightly worried about a few points of this company:

a) Lower occupancy of investment property. It is noted that the company seems to have an attraction to Savills, having it being the property manager and the property surveyor. AFAIK, their method of valuation is level 3, which is worrying because the increase in value of its properties looks like a bubble in itself.

b) Reducing earning ability of its main toy business. I am not enamored of the quality of its upcoming toys as well.

c) Slight increase in non-current loans for no reason despite its reasonably high cash position. I note that interest coverage this half is still a safe 20 times or so-- but why incur unnecessary debt?

d) Share buy backs using company's fund is encouraging but I rather the directors buy it using their own pocket and try to improve business.

e) I noted that the investment portfolio has increased by 40-50m or so, but there is no explanation for how they pick stocks, or who is managing their investments. Active investing is not easy-- especially with large money.

Overall gain in investment for Playmates, inclusive of the recent special dividends, is only 10%. This means I sold at break even price.

Moving on, I would like to share some opinions on retail investing.

Walter Schloss is my idol and I still find investing in his way the easiest. His returns might not be the highest, but investing is not about topping the class-- it is about getting decent returns over long period of time. I do think that if you end up in the top 25% of the investing community every year over long period of time (10 years), the results would be lovely.

However, buying a small position over many companies requires a full time job. After reading The Dhandho Investor, I feel the practical method is to buy when you have ascertain a huge opportunity, and bet heavily. I think 8 is enough for diversification.

In addition, the age-old belief in value investing is that you either buy a so-so company at a cheap price, or a great company at a fair price. Over time, I do think that the latter approach is easier. It is definitely easier to spot a company when it is cheap. If I have a sizable (400k-1m) amount of money to work with, leaving 50% of it for cheap companies is plausible. With the amount of money I have, I do need to rethink my approach to compound it efficiently.

a) Lower occupancy of investment property. It is noted that the company seems to have an attraction to Savills, having it being the property manager and the property surveyor. AFAIK, their method of valuation is level 3, which is worrying because the increase in value of its properties looks like a bubble in itself.

b) Reducing earning ability of its main toy business. I am not enamored of the quality of its upcoming toys as well.

c) Slight increase in non-current loans for no reason despite its reasonably high cash position. I note that interest coverage this half is still a safe 20 times or so-- but why incur unnecessary debt?

d) Share buy backs using company's fund is encouraging but I rather the directors buy it using their own pocket and try to improve business.

e) I noted that the investment portfolio has increased by 40-50m or so, but there is no explanation for how they pick stocks, or who is managing their investments. Active investing is not easy-- especially with large money.

Overall gain in investment for Playmates, inclusive of the recent special dividends, is only 10%. This means I sold at break even price.

Moving on, I would like to share some opinions on retail investing.

Walter Schloss is my idol and I still find investing in his way the easiest. His returns might not be the highest, but investing is not about topping the class-- it is about getting decent returns over long period of time. I do think that if you end up in the top 25% of the investing community every year over long period of time (10 years), the results would be lovely.

However, buying a small position over many companies requires a full time job. After reading The Dhandho Investor, I feel the practical method is to buy when you have ascertain a huge opportunity, and bet heavily. I think 8 is enough for diversification.

In addition, the age-old belief in value investing is that you either buy a so-so company at a cheap price, or a great company at a fair price. Over time, I do think that the latter approach is easier. It is definitely easier to spot a company when it is cheap. If I have a sizable (400k-1m) amount of money to work with, leaving 50% of it for cheap companies is plausible. With the amount of money I have, I do need to rethink my approach to compound it efficiently.

Wednesday, August 15, 2018

Portfolio Commentary: August.

The market has been terribly kind to me lately, and I feel embarrassed as I witness other investors' portfolio get smashed pretty bad. I perceive some of them to be better investors really, so I guess Lady Luck has something to do with it.

As of writing, portfolio returned 18.98%, versus a -2.04%. This lead of 21% over the index is unprecedented.

Transactions made since the last update included:

(a) Complete divestment of Wheelock Properties. While it was a low ball offer, it makes little difference if the price offered is 2.4 or 2.2. I was waiting for 2.3 but it meant very little difference to me. Gains, largely due to luck, is about 40%.

(b) Complete divestment of Religare Health Trust. This is a "special situation" component of my portfolio, but I think there is a few headwinds ahead. RHT brought home a 9.7% return.

i) general cheap stocks-- these stocks are typically bread-and-butter of your portfolio, and are expected to bring about most gains. However, they are likely affected by general market direction.

ii) special situation stocks-- these are stocks that moves without regard to general market sentiments. Gains are likely to be lesser, but they provide some kind of stability in a bearish market. Assessing how likely the deal will work out is the key here. The attractiveness of investing in such deals is a rough time line where annualized gains can be worked out.

I have since invested part of the sum from RHT's divestment on another idea. I hope to allocate more capital to this idea as I think this stock is reasonably cheap and the company's cash return is very satisfying. I will talk more about this company once I acquire a decent size amount of shares.

(c) Complete divestment of Perfect Shape, at about 40% as well. The annual report fail to explain why there is a growing amount of trade receivables. Funnily enough, the market is clearly not bothered about it and the stock went up significantly. Had I hold on to my stock, I would have my first ever 100% return from a stock. But holding on to it is not rational; the TR is no longer my problem but someone else.

(d) Increase in position of Innotek. For the CEO to double his positions at 40 cents a share, I thought getting a few stock at 36 cents is not a bad idea, and that was what I did yesterday. My luck seems incredible as I wake up to news today that Innotek has improved its latest quarter earnings dramatically. Stock closes at 42 cents, up 13.51%. Again, I take no credit for luck.

I must mention that this stock at one point bore unrealized profits of well over 50%, but I held on as I thought it is still too cheap. The stock corrected significantly after a poor quarter (typical market reaction that offer opportunities to the patient investor), to under 10% profit. This is stomach-wrenching volatility that a value investor have to endure at times.

There are still more than a couple of laggards in my portfolio-- laggards which will be favorably priced by the market sooner or later, I hope...

As of writing, portfolio returned 18.98%, versus a -2.04%. This lead of 21% over the index is unprecedented.

Transactions made since the last update included:

(a) Complete divestment of Wheelock Properties. While it was a low ball offer, it makes little difference if the price offered is 2.4 or 2.2. I was waiting for 2.3 but it meant very little difference to me. Gains, largely due to luck, is about 40%.

(b) Complete divestment of Religare Health Trust. This is a "special situation" component of my portfolio, but I think there is a few headwinds ahead. RHT brought home a 9.7% return.

***

A typical value investing portfolio looks like some this:i) general cheap stocks-- these stocks are typically bread-and-butter of your portfolio, and are expected to bring about most gains. However, they are likely affected by general market direction.

ii) special situation stocks-- these are stocks that moves without regard to general market sentiments. Gains are likely to be lesser, but they provide some kind of stability in a bearish market. Assessing how likely the deal will work out is the key here. The attractiveness of investing in such deals is a rough time line where annualized gains can be worked out.

***

I have since invested part of the sum from RHT's divestment on another idea. I hope to allocate more capital to this idea as I think this stock is reasonably cheap and the company's cash return is very satisfying. I will talk more about this company once I acquire a decent size amount of shares.

(c) Complete divestment of Perfect Shape, at about 40% as well. The annual report fail to explain why there is a growing amount of trade receivables. Funnily enough, the market is clearly not bothered about it and the stock went up significantly. Had I hold on to my stock, I would have my first ever 100% return from a stock. But holding on to it is not rational; the TR is no longer my problem but someone else.

(d) Increase in position of Innotek. For the CEO to double his positions at 40 cents a share, I thought getting a few stock at 36 cents is not a bad idea, and that was what I did yesterday. My luck seems incredible as I wake up to news today that Innotek has improved its latest quarter earnings dramatically. Stock closes at 42 cents, up 13.51%. Again, I take no credit for luck.

I must mention that this stock at one point bore unrealized profits of well over 50%, but I held on as I thought it is still too cheap. The stock corrected significantly after a poor quarter (typical market reaction that offer opportunities to the patient investor), to under 10% profit. This is stomach-wrenching volatility that a value investor have to endure at times.

There are still more than a couple of laggards in my portfolio-- laggards which will be favorably priced by the market sooner or later, I hope...

Subscribe to:

Posts (Atom)

-

STI Index Fund returns +0.55% (was +1.63% in April ) Hong Kong Tracker Fund returns -4.7% (was 0.01%) S&P 500 Index Fund returns +11%...

-

Obviously, this will be the final update for the year. Portfolio Return: +1.99% Straits Times Index Fund: +1.03% S&P 500: 24.25% Hong Ko...

Apr 2024 Portfolio Update (Hong Kong Recovery, Cordlife Teaser)

Don't ask me why there is a shoe missing. Maybe it reflects a missed opportunity on Anta Sports.. Topics Discussed: -Recovery of Hong Ko...