This post is made in reference to an earlier blog post. Basically, it is a list of stocks that has last closed prices at a significant discount to its tangible book value.

The first item on the list is China Haida, which is an S-Chip. Reputation wise, s-chips get a really bad name. But I believe in keeping an open and critical mind when investigating value stocks. Can this s-chip, penny stock be worth the risk?

Apparently SGX has been monitoring and the key concern is Interested Party Transactions. One of the easiest way to move capital out from a company is to write off account receivables, and hence buying a stock like China Haida is a risky venture.

I shall pass.

Pages

Search This Blog

Saturday, December 31, 2016

Sunday, December 11, 2016

Investigating Cheap Stock by Book Value

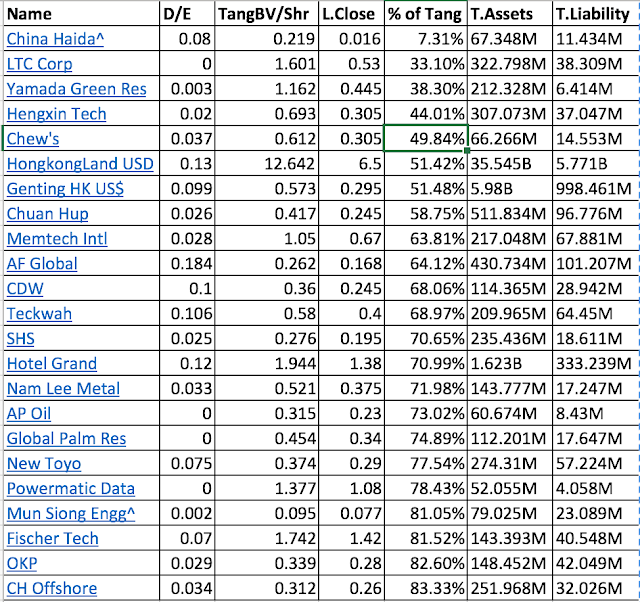

This list of stocks is unlikely to appeal to many people. Some of these are s-chips, and all if not most of them are experiencing problems, usually no profits at all. As you can see, most of them have next to no debt, and are selling at lower than its tangible assets per share.

More importantly, some of them are value traps, which refers to stocks that look cheap but isn't because of a variety of reasons-- management could be one of them.

I find this list of stocks intriguing and will be working to go through all of them. Diversification is the key, and over a long period of time, it will work to my favor.

More importantly, some of them are value traps, which refers to stocks that look cheap but isn't because of a variety of reasons-- management could be one of them.

I find this list of stocks intriguing and will be working to go through all of them. Diversification is the key, and over a long period of time, it will work to my favor.

Thursday, December 1, 2016

A Small Sum of Money

With a small sum of savings generating next to nothing interest in banks, my mum and I decided to close the account and invest this in some stocks. Since this money isn't really mine, I take on a much more prudent approach.

I diversified the capital in 4 stock at the moment and is disappointed not to be able to get to the 5th today, but I will wait

1) Hong Kong Lands- This company is the only one in the list that has a moat and is probably also the riskiest due to currency risk. However capital protection is assured and looking at charts, we are not at the high side/resistance. With its record of growing its NAV and also its properties, which are not easily replaceable in good times, it is pretty safe.

Dividend Yield is not fantastic at 3% but I imagine with its pretty low debt and brand name (most of its debt are unsecured, that is how much banks trust them).... I think it is safe.

2) Capitaland Retail China Trust

I believe in the management in overcoming its current problems. At 1.37, the book value of it being 1.55 and gearing at 36%, I think it is not the safest security but it is fine.

3) Chuan Hup

Low debt and good record increasing its book value. At the moment its subsidiary Finbar isn't doing too well but I believe sooner or later, in 4 years, things will change. Dividends at 4% will pay off.

4) Frasers Centrepoint Trust

Selling at book value and low gearing (28.3%). Good yield at 6%. I believe that malls serves as valuable meeting point for heartlanders as the city gets crowded.

I was looking at adding Nam Lee Metal but the stock rose too quickly today. I estimate that this company has a safe book value of 0.42 and we are looking at a 6 percent increase today. Nam Lee Metal is another company with little debt.

I am also monitoring the price of Mapletree Industrial Trust and will add if there is significant discounting.

I diversified the capital in 4 stock at the moment and is disappointed not to be able to get to the 5th today, but I will wait

1) Hong Kong Lands- This company is the only one in the list that has a moat and is probably also the riskiest due to currency risk. However capital protection is assured and looking at charts, we are not at the high side/resistance. With its record of growing its NAV and also its properties, which are not easily replaceable in good times, it is pretty safe.

Dividend Yield is not fantastic at 3% but I imagine with its pretty low debt and brand name (most of its debt are unsecured, that is how much banks trust them).... I think it is safe.

2) Capitaland Retail China Trust

I believe in the management in overcoming its current problems. At 1.37, the book value of it being 1.55 and gearing at 36%, I think it is not the safest security but it is fine.

3) Chuan Hup

Low debt and good record increasing its book value. At the moment its subsidiary Finbar isn't doing too well but I believe sooner or later, in 4 years, things will change. Dividends at 4% will pay off.

4) Frasers Centrepoint Trust

Selling at book value and low gearing (28.3%). Good yield at 6%. I believe that malls serves as valuable meeting point for heartlanders as the city gets crowded.

I was looking at adding Nam Lee Metal but the stock rose too quickly today. I estimate that this company has a safe book value of 0.42 and we are looking at a 6 percent increase today. Nam Lee Metal is another company with little debt.

I am also monitoring the price of Mapletree Industrial Trust and will add if there is significant discounting.

Subscribe to:

Comments (Atom)

-

I have sold out of all my Cordlife shareholdings at 0.24 per share. This is a pretty good annualized return of 85% from about a year of hold...

-

Portfolio Returns: 99.3% STI: 29.2% Tracker: 25.6% S&P 500: 13.35% I believe returns should be correct this time round since Evan of Sto...

The Ugliness of Human Beings

A pair of news had me thinking recently. The first would be the sudden passing of Mr. Ravi, a prominent lawyer in the activist circle. The s...