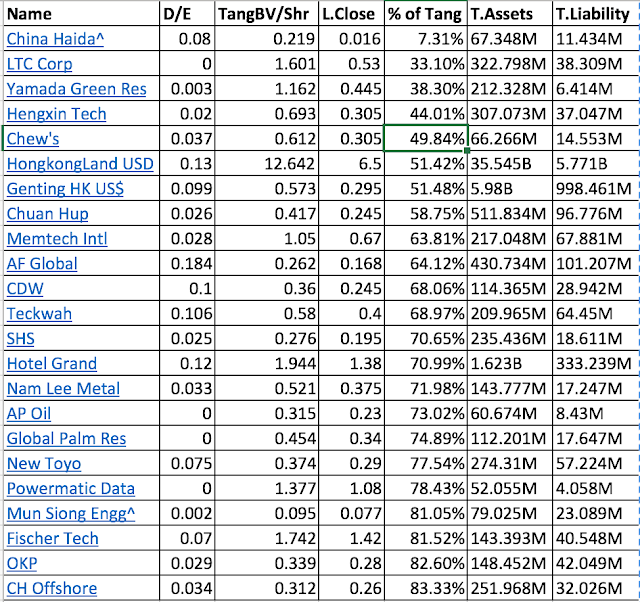

This list of stocks is unlikely to appeal to many people. Some of these are s-chips, and all if not most of them are experiencing problems, usually no profits at all. As you can see, most of them have next to no debt, and are selling at lower than its tangible assets per share.

More importantly, some of them are value traps, which refers to stocks that look cheap but isn't because of a variety of reasons-- management could be one of them.

I find this list of stocks intriguing and will be working to go through all of them. Diversification is the key, and over a long period of time, it will work to my favor.

Pages

Search This Blog

Subscribe to:

Post Comments (Atom)

-

I have sold out of all my Cordlife shareholdings at 0.24 per share. This is a pretty good annualized return of 85% from about a year of hold...

-

Portfolio Returns: 99.3% STI: 29.2% Tracker: 25.6% S&P 500: 13.35% I believe returns should be correct this time round since Evan of Sto...

Two Stories

There are two specific incidents in my life which I stubbornly stick to my principles, of which one of them had a major (ill) effect on my l...

No comments:

Post a Comment