Some of it is opportunity and some of it isn't. I feel that the following is worthy to think about

(a) if the sell-down is due to rational reasons that will hurt earnings. Prices follow earnings in the short term

(b) if the company is already a decent company without the crisis. Disregarding the price, is the company doing well?

-are share holder equity increasing?

-is return of invested capital increasing?

-is debt larger than equity? You might make a mistake, or the market might become inefficient for a long time.

-is dividend history steady?

(c) perform valuation and see if the discount is worth it.

Do note that WDC has a high beta of 1.6 (which means it moves up or down 1.6 times the rate of the market as a whole).

However, it doesn't matter what type of companies it is, or if the beta is high/low. What matters is if they are cheap and performing fine as a business.

The Selldown

Due to a large sell down by Seagate of 25% on 13-April-2016, investors panic and sold down WDC by 6.6%, and a further 3.2% the next day. The reasons given by Seagate's management was difficult PC marketMarket usually affects sector movements, and the entire sector usually moves in tandem. Hence a price movement like this is not unusual, given that WDC and Seagate are #1 and #2 in the market. I first read this from Jesse Livermore's Tandem Trading ideas.

This represent a support (which is the price-level where stocks seems to _not_ fall under) level at roughly 40-ish. This support is tested in mid Feb 2016, during which the markets rally together as a whole. Hence, it would be irreliable to mark this as a credible support given that it is untested.

Looking at its Financial Statements

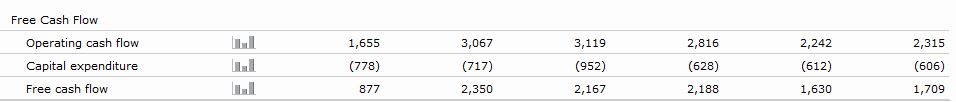

So how is WDC performing as a company? Let's take a quick look at Morningstar figures, which cost nothing to view. The first thing you want to look at is cashflowAs you can see, cashflow isn't spectacular, but decent.

Next, we look at how the company is performing under key ratios

I looked at the revenues and it has pretty good years till 2015. But the key thing is to look at gross and operating margins, since revenues can be propped by acquiring companies. I noted that gross and operating margins are very healthy, increasing even.

From the same page, I can see the Cost of Goods and Services (COGS) is going down. Assets turnover and return of assets is going down. Return of equity is going down, but still respectable at 12%. This means we should pay attention to it from quarter to quarter.

Interest coverage represents how well the company is repaying its loans. Company servicing its loans pretty well at 25.34.

Moving on to Income Statements, I tend to look at percentages instead of actual figures as it make sense. There is a "%" button to click on within Morningstar.

I can see that cost of revenue is kept well control, and gross profits are high. Company devotes money on R&D steadily. Again, note the low interest expense.

Next Balance Sheet

What I saw is about 30% of current assets in cash, but what pleases me is the ability of this company to get payments. Receivables is reducing since 2011.

Increasing receivables could present the company booking unpaid money as revenue. Be careful.

Inventory does not hold a great percentage of this company's balance sheet. You can take the the inventory figure, in exact cash figures, and compute it as a figure of revenues. This is known as asset turnover and represent the number of times a company turn over its assets. A increasing figure means efficiency.

Moving down to liabilities,

We can see that liabilities begin to lower... long term and short term (payable < 1 year) debt is kept low at less than 20%

Finally, when you subtract assets with liabilities, you get equity.

Equity fell from an incredible 2011 of 67.6% of the balance sheet to 53.98%. However, it has been increasing since. Lovely.

And finally, dividends history offers a clue if the company has shareholders' interests at heart.

Now that we are pretty happy with the company, it is time to check if the price is good.

Immediately I start to do my cashflow valuation on this stock and for a very modest rate of 3% growth, off a reduced free cashflow of 1.6 billion, and a 12 percent discount rate, I get a figure of about 40.4 dollars. I bought the stock at 40.75 on the 15-April and went to bed. Unfortunately I do miss out on the lowest price of 40.18, but you can never time the market.. this deal is almost a no brainer. Note again that I reduce free cash flow by 100 million dollars.

It doesn't matter if it is a technology or a brick-and-mortar business. WDC is a fairly decent company with a very decent discounts. It has pretty low debts as a company. However, WDC isn't a company with any sort of moat and needs to be monitored carefully.

Update: WDC announced lesser than expected earnings per share of 1.21 to the expected 1.28, with less revenue compared to the same quarter last year. The price fell by some 4 percent on after-market sales. I have liquidated my position at 47.2 earlier after noticing a huge resistance intra-day..

No comments:

Post a Comment